Leverage our talent and resources

Whether you're facing a business challenge and need some expert help – or just an extra pair of hands to get through the workload – KPMG Onsite Assistance is here to help! KPMG Onsite Assistance brings the experience and expertise of our highly specialized professionals.

We work directly with you, to help you solve your business challenges. Along with our core capabilities in tax, accounting, finance, and advisory services, we also offer a comprehensive range of specialist knowledge with experience across a wide range of industries and can tailor services to your needs.

While our commencement of work is subject to the clearance of our acceptance procedures, we often have someone working with you in as little as few business days.

View by Services:

Do you

-

find your accounting costs too high for a small business?

-

feel that ensuring regulatory compliance is a time-consuming and laborious task?

-

expect to find a reliable bookkeeping company and professional advisers to help a foreign investor?

-

require a flexible accounting service tailored to suit your company's needs?

-

think a temporary substitute for an employee needs extra resources and adds to your personnel expenses?

-

want to outsource part of your company's bookkeeping duties?

KPMG's professional and well-arranged bookkeeping services help clients achieve significant cost savings. Combining our skills and knowledge with the know-how of other KPMG advisory services, our bookkeeping specialists provide comprehensive support in all accounting areas.

Our services include:

-

Financial accounting and reporting

-

Special bookkeeping and reporting (controller services, payroll accounting, statistics, filling in tax returns, bookkeeping on the client's software, etc)

-

Preparation of financial statements

-

Preparation of financial statements for foreign owner in English.

Why choose KPMG?

-

Foreign investors and small businesses will find a reliable bookkeeping company and professional advisers

-

Companies can file monthly accounts and communicate in foreign languages without having to use extra translation assistance

-

Information will remain confidential

-

Outsourcing can yield cost savings

-

Small businesses do not need to spend time and resources on striving for regulatory compliance

-

Electronic data transmission [data export-import, (electronic reporting to the Tax inspection) and electronic reporting to the Social Security fund), and banking transactions] will make the information available and traceable for both the client and the accounting company.

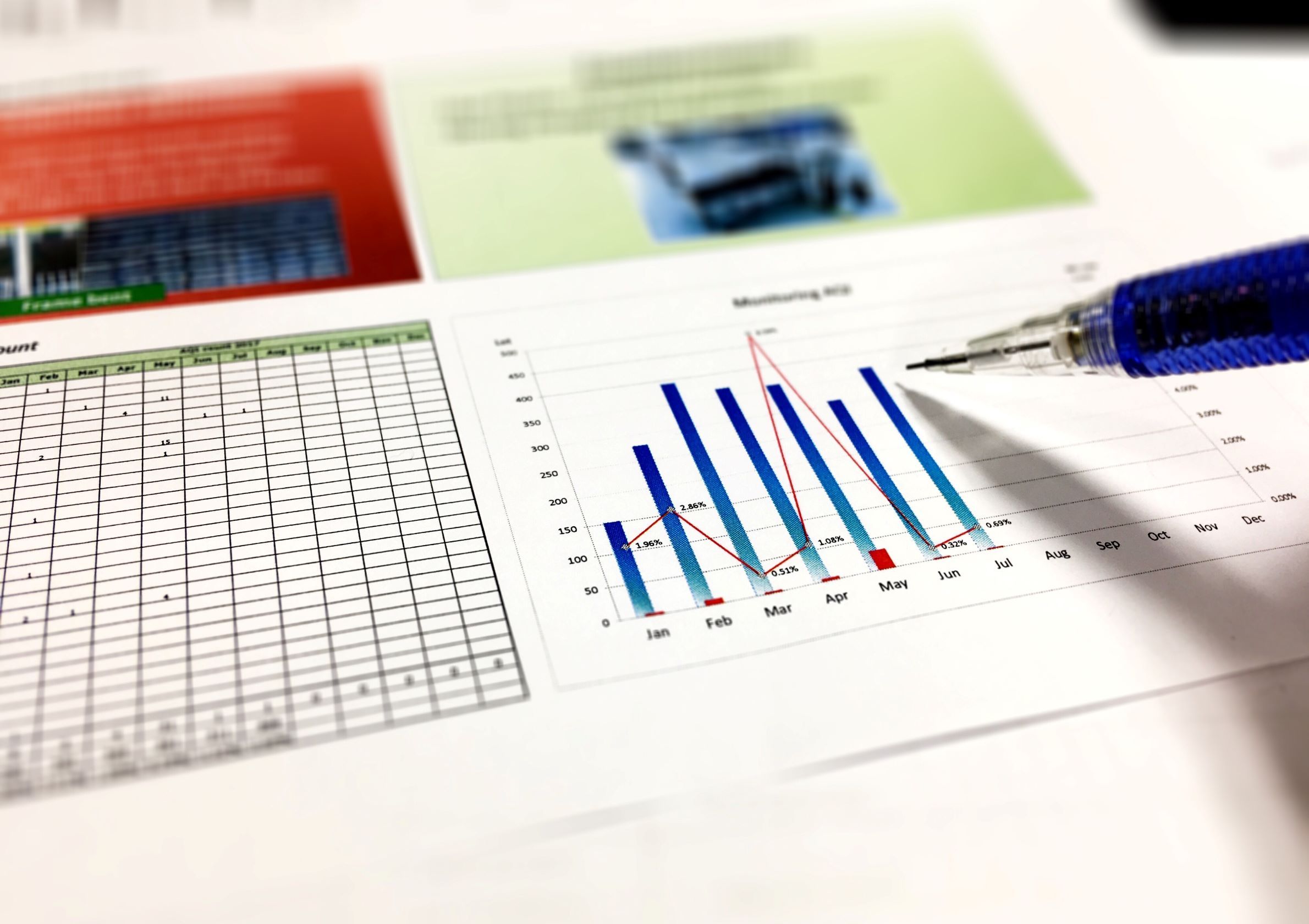

Spreadsheet-based modelling can provide business leaders with flexible tools to help make informed decisions, but such tools can suffer from a lack of quality, robustness, security and reliability. This could have a severe impact on the quality of decision-making. According to a KPMG survey, 70 percent of models contained errors that affected their results and over 75 percent of models had no formal quality assurance procedures.

KPMG’s Modelling team can help you build bespoke financial models that are flexible, robust, accurate and easy-to-use, with clear reports to deliver tangible business benefits. We also review and test models to enhance their quality and reliability, improving the overall quality of decision-making or third-party confidence in the outputs.

KPMG’s Modelling team can help you build bespoke financial models that are flexible, robust, accurate and easy-to-use, with clear reports to deliver tangible business benefits. We also review and test models to enhance their quality and reliability, improving the overall quality of decision-making or third-party confidence in the outputs.

What’s on your mind?

- Do you have the right information at the right time?

- How confident are you that your existing models are error-free, robust and reliable?

- Do you know the key assumptions and drivers used to generate management information and key metrics?

- Are you able to flex those assumptions easily and assess the impact on decisions?

- How much is poor quality information costing you?

Bringing you peace of mind with modelling advisory and consulting services

- Strategic Modelling and Option Appraisals: We build models to quantify and evaluate strategic directions or business options and scenarios.

- Transaction and Deal Modelling: We construct projection and valuation models to reflect the economics of the deal, the contractual terms, operational, accounting and tax assumptions, financing proposals and investor returns.

- Bid Modelling: We prepare financial models that meet best practice requirements, are robust, reliable and comply with the bid requirements. This enables the bidder to accurately price its bid.

- Operational Models: We build spreadsheet /database tools for quantifying and forecasting specific business operations. This includes budgeting, management and financial reporting, cash flow or treasury management, capital expenditure programs and working capital management.

- Restructuring and Financing Models: We build restructuring models to reflect financing requirements, capital structure scenarios, cash waterfalls, distributions and impact of new capital structures.

- Cost Optimisation Models: We construct bespoke tools for cost optimisation programs, including evaluation of outsourcing plans, managing staff costs and their impact on operational efficiency, profitability and shareholder value.

- Tactical (interim) solutions: We build fast-track bespoke solutions that offer the client flexible reporting, immediate business benefits and key user functionality at a fraction of the time and cost of larger, more cumbersome enterprise-wide solutions.

Modelling assurance services

- Model audits: We provide independent assurance on the accuracy, robustness and reliability of financial models, using specialist auditing software tools and a rigorous methodology.

- Design advice: We provide upfront advice on structural specification, design and construction, to improve robustness and reduce the risk of costly re-work.

- Contract compliance: We test inputs, assumptions and calculations against contractual documents and provide independent assurance that key contract terms have been accurately reflected in the model.

- Bespoke testing and model validation: We can focus on specific areas of concern or high risk aspects.

What’s in it for you?

- Improve the quality of your decision-making – Our modelling tools are flexible and are built to meet your precise information requirements

- Enhance the transparency of assumptions underlying your decisions – We clarify, articulate and document the key assumptions and drivers in your business.

- Trust – We provide you with robust tools that you and your stakeholders can trust or with independent quality assurance on your own tools.

There is no "digital economy". The economy is digital and "digits" refer to data. Data is the lifeblood of every organization on this planet and organizations that embrace this notion are well positioned to grow as industries continue to evolve and disrupt at an ever increasing pace. KPMG understands how the combined power of computing and mathematical techniques applied to data can rapidly derive business insights. We believe increased intelligence and speed to insight are a competitive advantage for your organization.

How we can help?

With a team of professionals that live at the intersection of business, technology and math and we can show you how various types of analytics can be a major competitive advantage in your business. Over the years we have helped several organizations innovate and adapt to change, grow their revenue, increase efficiency and have a better understanding of risk in this business.

In order to help our clients keep up with the pace of change, KPMG has set up a worldwide network of Insight Centers to provide our clients a next generation environment to rapidly ideate, innovate and prototype. These state of the art innovation and collaboration centric labs offer our clients an opportunity to "disrupt in a sandbox", mature their strategy and execution plans through a professional facilitated journey supported by data, analytics and visualization.

Grow your business

The customer should be at the heart of any organization's D&A strategy - Companies need to have a consolidated view of their customer and we believe it is much more than a single view of the customer. A consolidated view not only includes resolving many views of the internal customer profile, but also includes their interactions and transactions with the organization and the relationships, behaviors, wants and desires of the customer that often exist outside the organization.

KPMG specialists in Canada and around the world are helping leading organizations effectively leverage the extended data ecosystem to identify actionable insights that help identify new customer segments, capitalize on emerging market trends and develop new products and services.

Innovating

We can help organizations make better and faster decisions - Expanding our ability to develop the knowledge and innovative solutions necessary for delivering insight-rich D&A services is one of our foremost strategic priorities. The pace of change and disruption is increasing and organizations are challenged to keep up. Technologies and concepts like machine learning, cognitive computing, cloud and the Internet of Things (IoT) are game changing enablers, only if organizations understand the value these capabilities can bring. We believe guided experimentation and iteration allows our clients to incubate the change process and test new ideas with minimal investment and risk.

KPMG provides facilitated ideation sessions to help leadership teams deconstruct problem statements and through a creative design and collaborative process develop ideas and define solutions. Using the Insight Center and D&A Labs, clients can construct prototypes, test new ideas and if they work, rapidly deploy them. These collaborative spaces enable participants to share knowledge and capabilities, discover innovative opportunities, and develop the transformative solutions you need to compete.

Manage your risks

Organizations need confidence in their data quality and accuracy - As regulators become more active and the business environment becomes more complex, organizations are increasingly turning to data and analytics (D&A) to help control, predict and mitigate risk. By applying modern analytics techniques and technologies, organizations can now achieve unprecedented insight into the internal and external factors that drive risk and enhance compliance.

Enhance your performance

Improving and sustaining business performance is always top of mind for business leaders - D&A plays a critical role in maximizing performance across the extended enterprise. KPMG member firms are helping to maximize clients' implementation of analytics in their day-to-day operations in areas such as HR where they are applying analytics to help evaluate applicants' CVs. Others are using insights from their supply chain to drive costs out of their business and improve overall flexibility.

Challenges of the modern business environment require the constant monitoring of operations, organizational structures and processes by management, in order to find the most suitable business approaches on the market and thus increase profitability. One of the most common ways to increase efficiency and reduce operating costs is the review and reengineering of an operating model, organizational structure and internal processes in line with defined strategic goals.

With maximum flexibility, KPMG in Vietnam offers organizational and business and process analysis services for our clients: we are at your service whether it be regarding the whole company or only one service unit, a specific issue or a complex problem.

With the help of our services the operating costs of our clients can be significantly reduced in the mid term, while quick wins defined during the planning and development phases can lead to additional short-term efficiency improvements.

Possible gains:

- Simplified and more efficient operations, reduction of labor-intensive tasks and processes

- Increased efficiency of the organization, management monitoring and control functions

- Increasingly transparent and coherent enterprise operations focused on processes

- Reduction or elimination of duplications and parallel functions at the company, unit or individual job levels

- Quantified and tangible proposals in all areas backed up by detailed feasibility analysis and implementation plan

- Rationalization of manual workload

- Better utilization of the current IT infrastructure and functionalities

Our services and applications include:

- Organizational review: detailed analysis of focus areas

- Evaluation of outsourcing and business support optimization potential

- Business process review and development

- Development and design of internal rules of operation, controls and job descriptions

- Identification, adjustment and implementation of local and international best practices

- Definition and implementation of quick wins to increase organizational and operational efficiency

- Business Plan – creation of detailed development proposals with feasibility analysis and capacity planning

- Creation and execution of implementation plans

- Project management and monitoring

Boards and individual directors have a critical role to play in the governance, risk and strategy oversight of their organization. As business and society evolves, boards must be able to navigate the challenges and opportunities to ensure the sustainable growth of their business. This involves juggling the needs of multiple stakeholders in an increasingly interconnected world.

Boards must be operating effectively, be fully cognizant of their collective and individual responsibilities, able to make informed decisions based on an understanding of the key issues impacting their business strategy and be supported by robust governance frameworks.

How we can help

Our board advisory team is made up of governance, risk and strategy experts who can assist you and your board, to:

- benchmark and improve current governance frameworks against better practice

- undertake board and board committee evaluations that identify areas of strength and weakness in skills, behaviors, board meeting effectiveness, board reporting, board composition, stakeholder engagement, risk and strategy

- assist with development of board support tools including board documents, policies and processes that underpin a robust governance framework of risk management, strategy formulation, monitoring and assurance

- undertake tailored board training around risk, strategy and governance to assist boards to meet their fiduciary responsibilities

Our experienced team takes an objective and professional approach to managing the many risks from major change.

How KPMG can help

We can help you with the critical success factors for a wide range of projects, including:

- major business transformations such as mergers or acquisitions

- complex IT systems initiatives

- regulatory compliance or corporate governance.

KPMG employs leading concepts and practices, supported by:

- experienced practitioners

- project planning tools

- documentation templates

- benchmarking standards

- built-in knowledge transfer.

Project Advisory Services can generate significant cost savings by minimizing:

- poor selection decisions

- costly overruns

- misalignment with business needs

- poor quality deliverables

- failed projects.

We can help improve the effectiveness of change within your organization and increase the likelihood of your project’s success.

Benefits include:

- cost reduction through reallocation of resources towards more productive project

- evaluation of the effectiveness of project management controls for senior management or external parties (e.g. regulators)

- continuous alignment of products, program, projects with overall business goals

- proactive advice on how to enhance processes and controls

- validation and verification of contractor deliverables by leveraging the qualifications of our KPMG subject matter experts.

Supporting a successful implementation project

Enterprise wide technology projects have become a way of life for organizations. Many companies are now partnering with external solution providers to deliver services that are beyond their capabilities.

While these projects can bring substantial benefits, they can become disruptive and costly; dominating time and resources and affecting core business activities.

Large scale programs and projects are complex and place new demands on an organization. If not properly managed, they often result in significant business and financial risks.

To ensure success with their projects, organizations must:

- define business requirements

- determine the ‘fit’ of particular software solutions

- choose the right vendors.

KPMG offers an extensive range of Accounting Outsourcing Services, customized to address the needs of both big and medium-sized companies. In offering such services we rely on our skills with respect to outsourcing engagements, our past experience, and our profound knowledge of statutory accounting regulations, Vietnamese tax legislation, and IFRS.

The major services offered are:

- Bookkeeping services, ranging from full outsourcing to accounting supervision services.

- Preparation of statutory accounts and respective filings.

- Preparation of management accounts and reports.

- Financial reporting following IFRS.

- Corporate income tax return preparation.

- Other tax return preparation.

- Preparation and filing of year-end tax returns and reports.

- Preparation of VAT returns and reports (intra-stat and listing).

- Filing of VAT refund application and assistance throughout the entire process until the collection of the refund.

- VAT representation services and assistance with preparation of tax returns and reports and respective filings.

View by Industries:

Our Automotive network brings together our Audit, Tax, Law and Advisory professionals to help us take a broad ranging approach to our clients’ activities within the industry.

The global automotive market is diverse. It ranges from original equipment manufacturers (OEMs) and component manufacturers, to dealerships and commercial vehicle manufacturers. There is potential for growth across many areas, from the booming manufacturing and domestic markets and other developing economies, to the research and development of ‘greener’ vehicles and fuels. KPMG’s Automotive sector offers a pro-active, forward-thinking service to our firms' clients to help ensure that the potential for growth that the industry is currently witnessing is not missed, and that the issues and challenges faced by the industry can be overcome.

We bring knowledge and experience from KPMG member firms around the world to help banks manage the challenges they are facing.

With a wealth of industry experience and specialist knowledge, our firms’ banking professionals can add value to your business. Higher capital requirements, simplified legal structures, shrinking spreads, costly regulatory burden and overall market volatility are just some of the challenges that retail and investment banks face in this new era. We offer professional services to retail banks, capital markets, exchanges, financial intermediaries (i.e. clearing houses) as well as wholesale banks at local, national and global levels.

We welcome the opportunity to discuss how KPMG member firms can help you achieve your business objectives so please contact us below with any questions you may have.

The chemical industry’s competitive landscape is changing fast.

KPMG's Consumer Markets practice encompasses food, drink, consumer durables and fast moving consumer goods (FMCG), as well as luxury goods.

At KPMG it is important to us to work with our clients to develop strategic steps for successful business transformations. We work with you to adapt and capitalize on the trends being set by today's rapidly changing environment.

With deep industry experience, insight and technical support, our qualified professionals are among the leaders in delivering a broad range of audit, tax, legal and advisory services to meet the unique needs of consumer companies

KPMG's Energy practice works with major organizations in a variety of energy related sectors to respond to business issues and trends.

Our professionals provide services specifically to the Oil & Gas and Power & Utilities sectors.

KPMG’s Government & Public Sector practice works to deliver meaningful results through a deep understanding of the issues, an intimate appreciation of how the public sector works, and local insight into the Vietnamese cultural, social and regulatory environment.

KPMG Government & Public Sector professionals, many of whom have held senior public sector roles, consistently strive to combine their practical, hands-on local experience with insight from our global network to help our clients implement transformational strategies, economically, efficiently and effectively.

Our professionals work across a broad range of industries and sub-sectors including Infrastructure, Healthcare and Energy, to provide integrated, holistic advice.

Whether looking to exercise fiscal restraint or manage the challenges associated with a rapidly urbanizing population, KPMG brings a creative and innovative approach to problem solving that reflects their keen understanding of the public sector operating environment and relevant private sector insights to achieve sustainable results.

KPMG’s dedicated Healthcare Advisory Team is ready to work ‘Shoulder-to-Shoulder’ with you to explore and act on opportunities in this space.

Over the past two decades, Vietnam has achieved laudable improvements in key quality of life metrics such as life expectancy, infant mortality, and access to affordable medicines. This success is the result of the government’s concerted effort to modernize the health system and expand access to affordable care. As of writing, Vietnam has expanded its Universal Health Coverage (UHC) to 90% of the population, and targets to reach a 95% coverage ratio by 2025, while maintaining a commitment to sustainable healthcare financing. This coverage ratio and ambition leads comparable regional markets.

Vietnam is laying the foundation for a smart healthcare industry that includes disease prevention, medical examination and treatment, as well as health management. Advancements in these areas will create opportunities for international investors to participate in Vietnam’s digital health transformation.

Fueled by the experience and expertise of our industry professionals, we help clients confront the complex challenges of today’s constantly changing environment to position themselves for growth.

As customers look for innovation and quality at increasingly competitive prices, IM companies must look for new ways to manage risk, deliver exceptional products and reduce costs and time to market. While IM companies find themselves seeking opportunities for growth in both developed and high growth markets, we can help our clients adjust their business models to thrive within new cultures and operating environments and stay ahead of the competition.

Our infrastructure professionals are privileged to be involved in many exciting projects across all sectors and stages of the infrastructure lifecycle.

Infrastructure is one of the most complex challenges of the 21st century – but we know what it takes to drive value from these assets and programs. Learn more about what we are observing globally and let us help you navigate complex infrastructure challenges with practical advice drawn from hands-on local experience and deep sector expertise.

Today’s insurers face a wide range of complex challenges, from navigating financial market uncertainty and evolving consumer demands to outpacing digitally savvy new competitors.

While these factors may add new risk, they also present opportunities for insurers, reinsurers, and brokers, to rethink strategy, redesign financial and capital models, revamp sales, service and support processes with technology, or explore new growth in emerging markets or through product innovation.

KPMG’s multi-disciplinary insurance teams, led by senior partners with deep industry expertise and strong client relationships, emphasize collaboration and knowledge transfer to help ensure your organization is empowered for the future.

Passion, it’s what drives entrepreneurs, family businesses and fast-growing companies alike. It’s also what inspires KPMG Private Business to help drive your success.

Look to our trusted advisers to bring the clarity you need to help your company excel at every step of your business journey.

KPMG is involved in every stage of the asset and investment lifecycle, and offers experience in working with all levels of stakeholders throughout the real estate industry.

Whether your focus is local, national, regional or global, we can provide you with the right mix of experience to support and enhance your needs and ambitions. Our knowledgeable real estate professionals focus on providing informed perspectives and clear solutions, drawing experience from a variety of backgrounds including accounting, tax, legal, advisory, banking, regulation and corporate finance.

Our client focus, our commitment to excellence, our global mindset and consistent delivery build trusted relationships that are at the core of our business and reputation.

Consumers are far more aware than ever. They want to know how products are made, how they’re delivered, how ethical, how sustainable and how safe they are. These evolving expectations and innovations are driving the need for faster and more reliable operational collaborations from the retail sector.

At KPMG it is important to us to apply a conscious and substantial commitment to our clients businesses. We work with you to modify and adapt corporate strategies to meet and exceed the standards being set by this rapidly changing environment.

With deep industry experience, insight and technical support, our qualified retail professionals are among the leaders in delivering a broad range of audit, tax, legal and advisory services to meet the unique needs of consumer companies.

In a sector driven by fast-growth, the emergence of non-traditional competitors and markets challenges established technology business models.

From startups to Fortune 500 companies, Technology companies worldwide aim to secure their market position through disruptive innovation. As new technologies are adopted around the world, it has become increasingly important for the leaders in this sector to understand the complexity and business transformation impact of rolling out these new products and services.

How can we help?

KPMG’s technology professionals understand this changing and challenging environment. We combine industry knowledge with technical experience to provide insights that help technology leaders deal with their complex business models. Our professionals go beyond today's challenges to anticipate the potential long and short-term consequences of shifting business, financial and technology strategies. We also help clients explore potential obstacles to change and collaborate on critical decisions that can deliver real value to their businesses.

We understand the financial and operational drivers of the transport sector and can assist our firms' clients in dealing with current and emerging issues such as market consolidation, deregulation, public private partnerships and financing.

Build the right team based on your requirements

Onsite Assistance provides solutions for organizations that may need short-term resources to strengthen their executive team, lead a project or program, provide an injection of skills that are lacking, or to simply transform their business.

With over 1,700 professionals in Vietnam and Cambodia, KPMG can quickly place seasoned resources with proven track record on temporary assignments to help your team cope with short term challenges as per your need.